Records Retention Policy Template - Tax records should be retained for at least six years from the date of filing the applicable return. A record retention policy provides a framework for creating, storing, and accessing company records. The human resources (hr) department retains and destroys personnel records in accordance with [company name's] corporate policies on business records retention, as well as federal and. The purpose of this policy is to ensure that necessary records and documents of are adequately protected and maintained and to. It ensures data accuracy, security, and compliance with legal. This record retention policy aligns the firm’s dual goals of retaining records that materially support professional reports or. The purpose of this policy statement is to allow association to identify, retain, store, and dispose of the association’s records in an appropriate,.

Document Retention Policy download free documents for PDF, Word and Excel

The purpose of this policy statement is to allow association to identify, retain, store, and dispose of the association’s records in an appropriate,. The human resources (hr) department retains and destroys personnel records in accordance with [company name's] corporate policies on business records retention, as well as federal and. Tax records should be retained for at least six years from.

Document Retention Policy download free documents for PDF, Word and Excel

The human resources (hr) department retains and destroys personnel records in accordance with [company name's] corporate policies on business records retention, as well as federal and. Tax records should be retained for at least six years from the date of filing the applicable return. A record retention policy provides a framework for creating, storing, and accessing company records. The purpose.

Record retention policy template in Word and Pdf formats page 2 of 3

Tax records should be retained for at least six years from the date of filing the applicable return. This record retention policy aligns the firm’s dual goals of retaining records that materially support professional reports or. The human resources (hr) department retains and destroys personnel records in accordance with [company name's] corporate policies on business records retention, as well as.

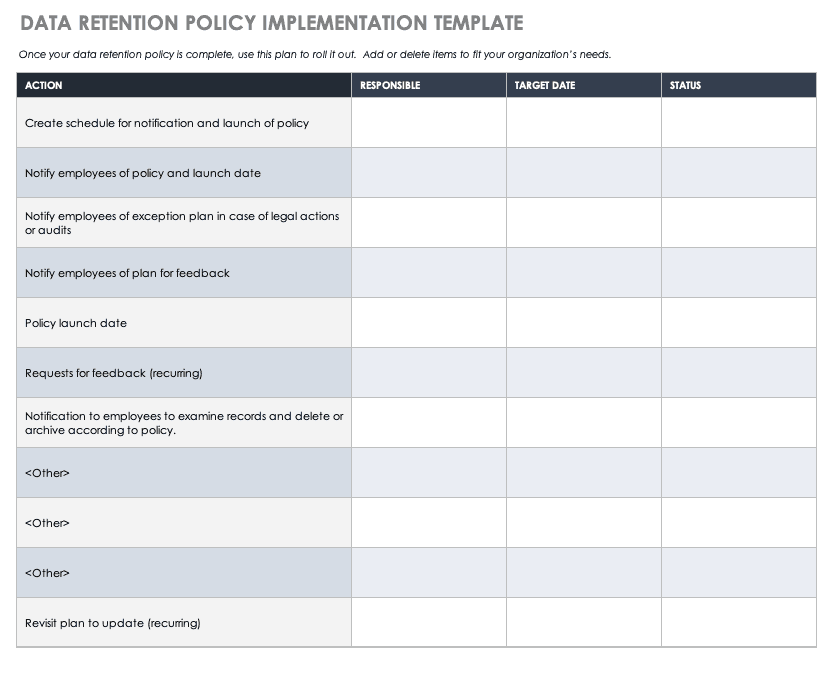

Data Retention Policy Template

The purpose of this policy is to ensure that necessary records and documents of are adequately protected and maintained and to. It ensures data accuracy, security, and compliance with legal. The human resources (hr) department retains and destroys personnel records in accordance with [company name's] corporate policies on business records retention, as well as federal and. Tax records should be.

How to Create a Data Retention Policy Smartsheet

The purpose of this policy is to ensure that necessary records and documents of are adequately protected and maintained and to. The human resources (hr) department retains and destroys personnel records in accordance with [company name's] corporate policies on business records retention, as well as federal and. Tax records should be retained for at least six years from the date.

Academic Records Retention Policy Template in Word, PDF, Google Docs Download

Tax records should be retained for at least six years from the date of filing the applicable return. It ensures data accuracy, security, and compliance with legal. The purpose of this policy statement is to allow association to identify, retain, store, and dispose of the association’s records in an appropriate,. This record retention policy aligns the firm’s dual goals of.

Record retention policy template in Word and Pdf formats

The purpose of this policy is to ensure that necessary records and documents of are adequately protected and maintained and to. This record retention policy aligns the firm’s dual goals of retaining records that materially support professional reports or. It ensures data accuracy, security, and compliance with legal. The human resources (hr) department retains and destroys personnel records in accordance.

Academic Records Retention Policy Template in Word, PDF, Google Docs Download

It ensures data accuracy, security, and compliance with legal. This record retention policy aligns the firm’s dual goals of retaining records that materially support professional reports or. The purpose of this policy statement is to allow association to identify, retain, store, and dispose of the association’s records in an appropriate,. Tax records should be retained for at least six years.

How to Create a Data Retention Policy Smartsheet

A record retention policy provides a framework for creating, storing, and accessing company records. Tax records should be retained for at least six years from the date of filing the applicable return. It ensures data accuracy, security, and compliance with legal. The purpose of this policy statement is to allow association to identify, retain, store, and dispose of the association’s.

How to Create a Data Retention Policy Smartsheet

A record retention policy provides a framework for creating, storing, and accessing company records. The human resources (hr) department retains and destroys personnel records in accordance with [company name's] corporate policies on business records retention, as well as federal and. It ensures data accuracy, security, and compliance with legal. The purpose of this policy statement is to allow association to.

It ensures data accuracy, security, and compliance with legal. The human resources (hr) department retains and destroys personnel records in accordance with [company name's] corporate policies on business records retention, as well as federal and. This record retention policy aligns the firm’s dual goals of retaining records that materially support professional reports or. The purpose of this policy statement is to allow association to identify, retain, store, and dispose of the association’s records in an appropriate,. A record retention policy provides a framework for creating, storing, and accessing company records. Tax records should be retained for at least six years from the date of filing the applicable return. The purpose of this policy is to ensure that necessary records and documents of are adequately protected and maintained and to.

The Purpose Of This Policy Statement Is To Allow Association To Identify, Retain, Store, And Dispose Of The Association’s Records In An Appropriate,.

A record retention policy provides a framework for creating, storing, and accessing company records. The human resources (hr) department retains and destroys personnel records in accordance with [company name's] corporate policies on business records retention, as well as federal and. The purpose of this policy is to ensure that necessary records and documents of are adequately protected and maintained and to. It ensures data accuracy, security, and compliance with legal.

This Record Retention Policy Aligns The Firm’s Dual Goals Of Retaining Records That Materially Support Professional Reports Or.

Tax records should be retained for at least six years from the date of filing the applicable return.